If you haven't already, please join us on our LinkedIn page, where you'll find valuable industry updates, reports, surveys, case studies and insights, as well as information on upcoming BIE events and news.

We will run a check on Companies House to ensure your company is active and that you are listed as a current Director.

This must be in your company name and is to confirm we are paying the correct business account and have the right details.

This is to ensure we are applying VAT where appropriate.

BIE requires all our interims working through a limited company to have all three types of insurances with the minimum cover specified below. Cover can be purchased jointly or separately from most reputable insurance companies. Please do seek professional advice if needed.

The levels of insurance cover required may vary depending on the client’s individual requirements and BIE will advise if higher levels are required for your particular assignment.

This is specific commercial business insurance that offers protection for your business which includes cover for professional negligence, if a client believes you have offered poor advice, made a mistake or if there is a disagreement. It is often a priority to have when your business provides professional services, including expert advice and consultancy.

Public liability covers claims of loss of or damage to a client’s property (for example, if you knocked a coffee over their company laptop or machinery), and claims made by any members of the public for incidents that occur in connection with your business activity. This insurance would cover you for most scenarios where a client or other counterparty could take you to court. Please note this insurance cannot protect you retrospectively.

If your role is outside IR35 then the ‘right for substitution’ denotes you are able to bring in a suitable substitute if the need arose. This insurance can safeguard your business from potential financial repercussions if anything happens to the employees or substitutes of your limited company.

We will need to ensure you are eligible to work in the location identified by the client.

If this is in the UK or Ireland and you hold a British or Irish passport, then you will be asked to complete a ‘Right to Work’ check through our providers. You will receive a message to your mobile phone, and you will be asked to complete the screening process (it will not keep any personal information on the phone after the check is completed). This short video and one-pager may help you complete it (please note once the chip is being read by your phone, don’t move it until it has finished scanning the chip).

If you do not have a UK passport, please also provide your right to work share code (https://www.gov.uk/view-prove-immigration-status) or a copy of your visa or permit that shows you are eligible to work in the UK.

This is to ensure what you have specified on your CV is accurate and up to date. Copies may be provided to the client on request.

This is to ensure what you have specified on your CV is accurate and up to date. Copies may be provided to the client on request.

This is to verify your current address.

Once we have received the requested information and the signed contracts from the client and your limited or umbrella company, our Finance team will send you log-in details for the timesheet portal. You will not receive these until we have received and processed all required paperwork.

If your role is outside IR35, you will need your own limited company so that we can make payment directly into your business bank account. If you don’t have a limited company, we suggest you seek professional advice.

If you need any further assistance, please contact your Consultant or Business Support Manager.

If your assignment is deemed to be inside IR35 then for tax purposes we require you to work through one of our approved umbrella companies, please ask your Business Support Manager for our current umbrella list.

These companies will make the necessary legal deductions including taxes and levies, which ensure that you, ourselves and our clients are all complying with the legal requirements.

You will receive an Opt Out Notice with your BIE contract. This notice relates to opting out of the Conduct of Employment Agencies and Employment Business Regulations 2003.

By signing this you will be opting out of being under the supervision, direction and control of the client. Should you be uncertain about any areas, please seek professional advice.

After processing your paperwork (please refer to “Types of information you may be asked to provide”), we will set you up on ETZ (our online timesheet portal) and you will be emailed login details from our Finance team. If you believe you have provided all requested documentation and have not received your login within a few working days, please check with the Business Support Manager for anything outstanding.

When completing your timesheets, please ensure you only enter the time you have actually worked, do not include any holiday days or days off sick. If for any reason you are working any days or times outside of usual office hours, please ensure you receive prior approval in writing from the client.

Your timesheets will be sent to the timesheet approver for sign-off.

Please note, any expenses you want to claim are generally required to conform to the client expenses policy, please ask your time-sheet approver for details of their policy and also direct any questions about it to your approver, if you are still unsure.

How you then claim your expenses through BIE depends on whether you are working via a VAT registered or non-VAT registered company. You will receive instructions from our Finance team about this, once all paperwork has been processed.

If you have any queries please contact finance@bie-executive.com.

You don’t need to send us an invoice, BIE employs a Self-Billing agreement. Your limited or umbrella company will receive a ‘self-bill’ document to sign as part of the onboarding which enables us to raise invoices to BIE on your behalf.

Once your timesheets have been authorised, your pay will be added to the next payment run (see 'How do I get paid?' for link to dates). After the payment run your limited or umbrella company will be emailed the invoice. You will also be able to access all of these on the ETZ portal.

You do not need to send us an invoice. A Self-Billing Agreement will be sent with your contract to be signed electronically and once completed, it allows us to raise invoices on your limited or umbrella company’s behalf to BIE. We will send a new Self-Billing Agreement each year to be signed. Please keep a copy for your records (not relevant if you are working through an umbrella company).

You can find out further information about self-billing here:

https://www.gov.uk/guidance/self-billing-notice-70062

https://www.gov.uk/guidance/vat-self-billing-arrangements

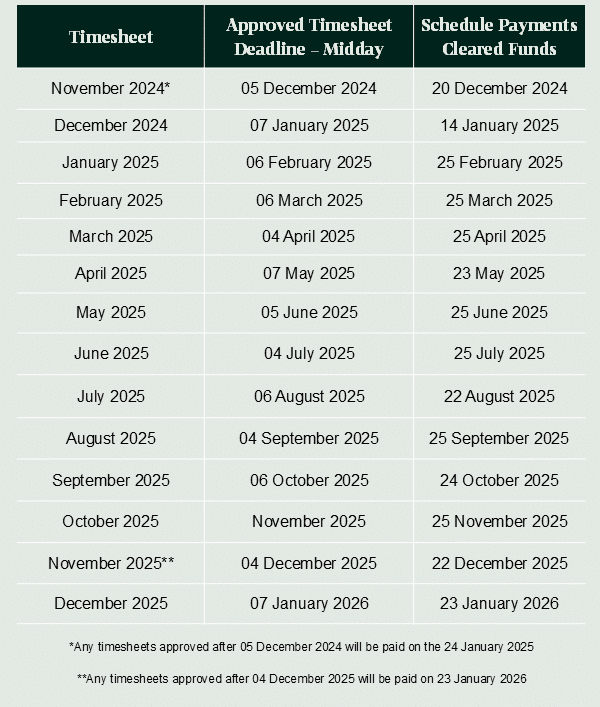

Payments will be made based on the submission of your approved timesheets. Payment runs are made monthly on the 25th (or next working day) and are subject to 3 days clearing (subject to change by one or two days if on, or close to a weekend or public holiday).

Please see the table below for the current payment schedule (subject to change by one or two days if the payment date is on a weekend or public holiday):